36+ debt to income ratio for a mortgage

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Web In general lenders prefer that your back-end ratio not exceed 36.

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

50 or higher DTI.

. Web How to calculate your debt-to-income ratio. Why Not Borrow from Yourself. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

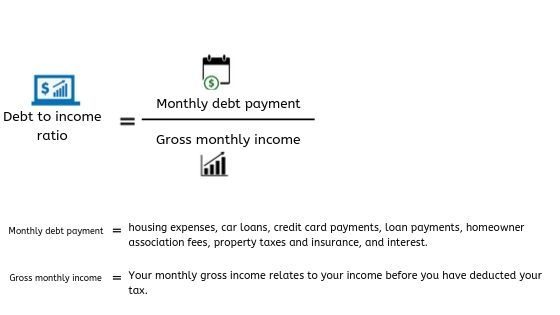

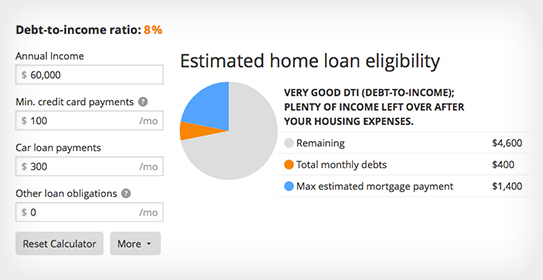

Ad Put Your Home Equity To Work Pay For Big Expenses. Web This is the ratio of your total monthly debt payments compared to your gross monthly income. Ad 5 Best House Loan Lenders Compared Reviewed.

Were Americas Largest Mortgage Lender. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Ad 5 Best House Loan Lenders Compared Reviewed.

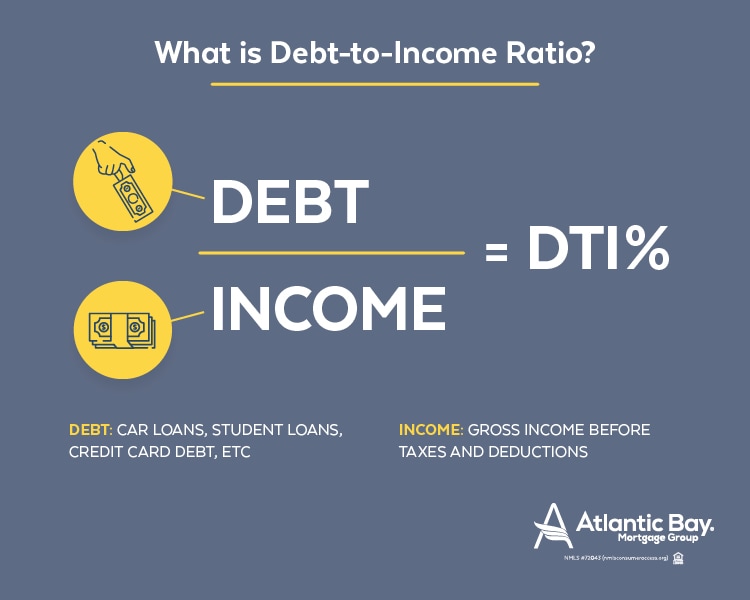

Web The 2836 rule is an addendum to the 28 rule. Web Debt-to-income ratio total monthly debt paymentsgross monthly income. That means if you earn 5000 in monthly gross income your total debt obligations should be.

Lock Your Mortgage Rate Today. Were Americas Largest Mortgage Lender. Web How to lower your debt-to-income ratio.

Web Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Apply Now With Quicken Loans. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Comparisons Trusted by 55000000. Compare Lenders And Find Out Which One Suits You Best. Lock Your Mortgage Rate Today.

28 of your income will go to your mortgage payment and 36 to all your other household debt. First Time Home buyerWhat are the fees for purchasing a homeFirst-Time Homeownership TipsAre you a first-time h. Web Figuring out your debt-to-income ratio today can help you with tomorrows mortgage.

Web The ideal DTI is 36 according to the Consumer Protection Finance Bureau. Web Here are debt-to-income requirements by loan type. Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses.

The rule says that no more than 28 of your gross monthly income. Apply Online To Enjoy A Service. According to the 2836 rule youd ideally want your back-end ratio to.

Compare Lenders And Find Out Which One Suits You Best. Youll usually need a back-end DTI ratio of 43 or less. Lenders consider a DTI of 36 as.

1 2 For example. Some lenders will consider you for a loan with a ratio of 43 but generally no. Web For example if your monthly debt equals 2500 and your gross monthly income is 7000 your DTI ratio is about 36 percent.

Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Web 36 to 49 means your DTI ratio is adequate but you have room for improvement. Compare Apply Directly Online.

Lower your monthly debt obligations. Your monthly expenses include 1200. For example if your monthly pre-tax income.

Apply Now With Quicken Loans. Looking For a House Loan. Web A good debt-to-income ratio for a mortgage is generally no more than 36 and lower is better because it shows lenders you are unlikely to default.

Temporarily prioritize debt payments over savings and investment account. Lenders might ask for other eligibility requirements. Highest Satisfaction for Home Loan Origination.

Ad Compare Mortgage Options Calculate Payments. If your home is highly energy-efficient. Comparisons Trusted by 55000000.

You have a pretax income of 4500 per month. Web A low DTI means you have a good balance between debt and income so a lower percentage increases your chances of approval. What factors make up a DTI.

Looking For a House Loan. If your home is highly energy-efficient. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Ad Compare Mortgage Options Calculate Payments.

Why Mortgage Applications Get Rejected What To Do Next

Debt To Income Ratio Crb Kenya

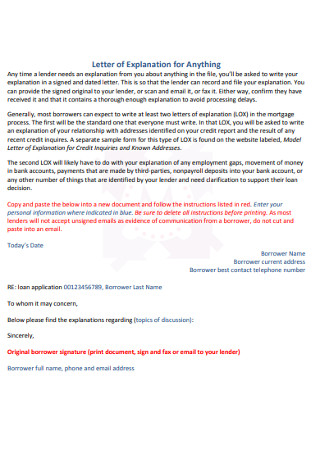

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Debt To Income Dti Ratio What S Good And How To Calculate It

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health

How Your Debt To Income Ratio Can Affect Your Mortgage

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Report On The Living Conditions Of Roma Households In Slovakia 2010 By United Nations Development Programme Issuu

Debt To Income Ratio Calculator Nerdwallet

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

What Is The Debt To Income Ratio Learn More Citizens Bank

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

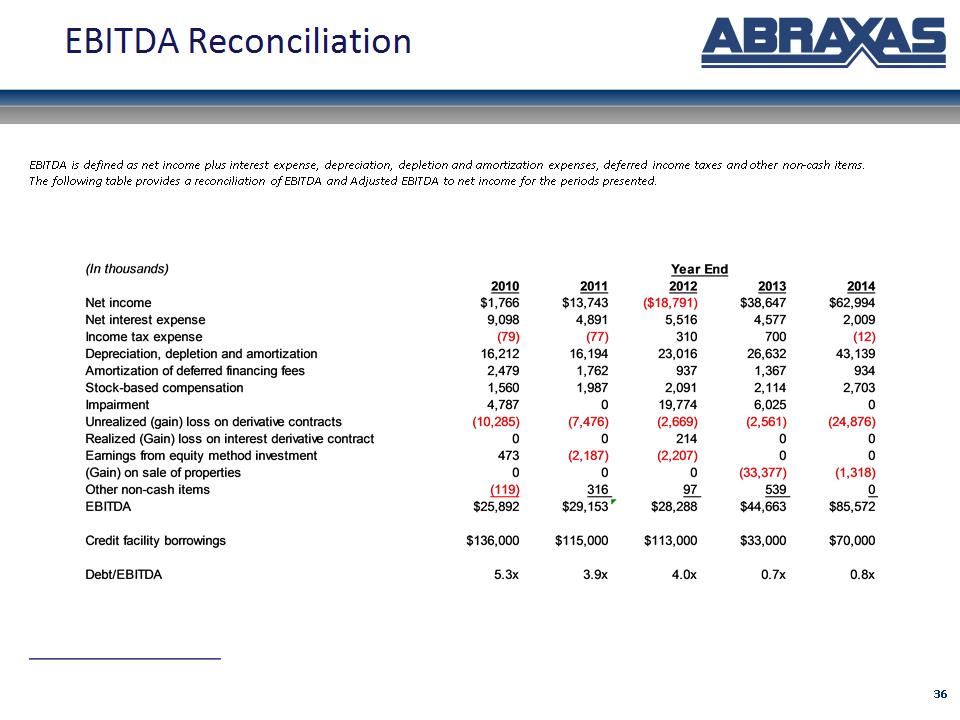

Presentation Htm

Debt To Income Ratio Calculator What Is My Dti Zillow

What S A Good Debt To Income Ratio For A Mortgage

What Is The Debt To Income Ratio For A Mortgage Freeandclear